Dealing with Charge Offs on Your Credit Report

Understand charge-offs and discover strategies to manage and potentially remove them from your credit history.

Understand charge-offs and discover strategies to manage and potentially remove them from your credit history.

Dealing with Charge Offs on Your Credit Report

Hey there! Let's talk about something that can be a real headache for your credit score: charge-offs. If you've ever missed a bunch of payments on a credit card, loan, or other debt, you might have encountered this term. A charge-off isn't just a missed payment; it's a declaration by your creditor that they've given up on collecting the debt from you. Sounds a bit dramatic, right? Well, it is, because it has a pretty significant impact on your credit report and, by extension, your financial life.

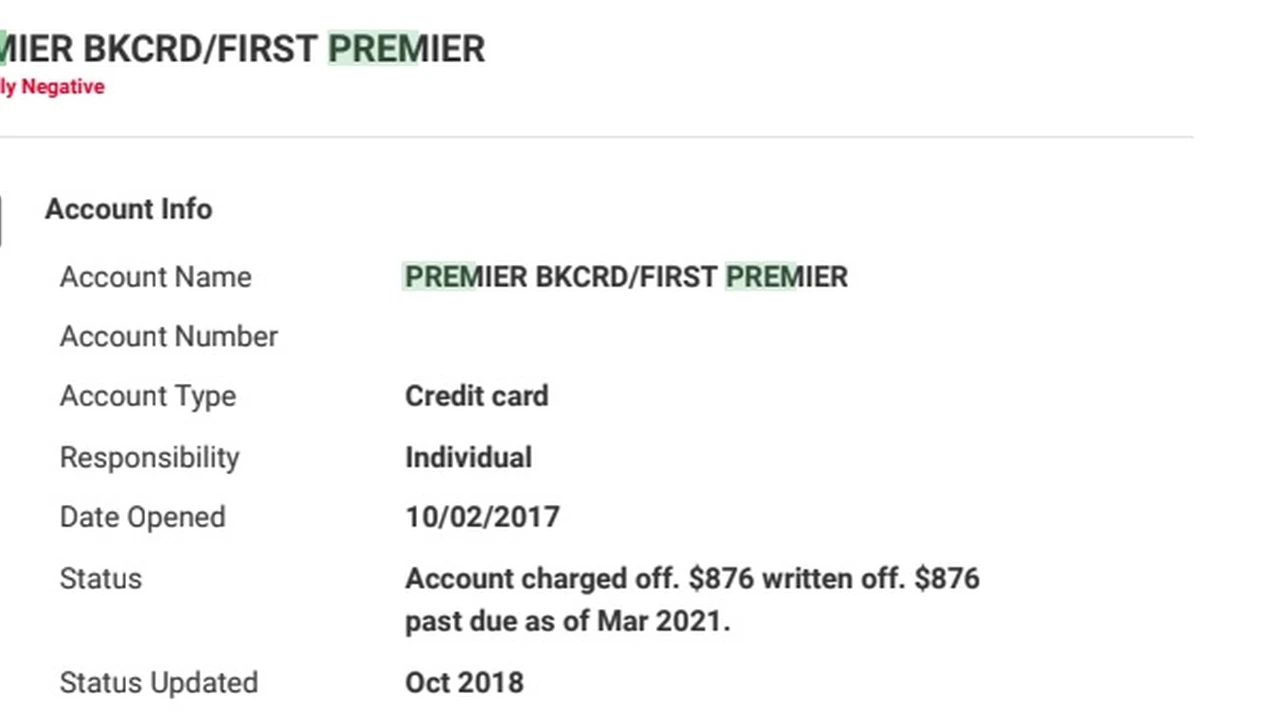

When a creditor charges off an account, it means they've written it off as a loss on their accounting books. This usually happens after several months of non-payment, typically around 180 days past due. But here's the kicker: just because they've charged it off doesn't mean you're off the hook. You still owe the money! The creditor might sell the debt to a third-party collection agency, or they might try to collect it themselves. Either way, that charge-off will sit on your credit report for up to seven years from the date of the first missed payment that led to the charge-off. That's a long time to have a black mark affecting your ability to get new credit, loans, or even rent an apartment.

So, what can you do about it? Don't despair! While a charge-off is serious, there are definitely strategies you can employ to manage it and even work towards getting it removed or at least minimizing its impact. Let's dive into some practical steps and product recommendations that can help you navigate this tricky situation.

Understanding Charge Offs What They Mean for Your Credit Score

First things first, let's really get to grips with what a charge-off signifies. When an account is charged off, it's a clear signal to potential lenders that you've failed to meet your financial obligations. This is a major negative mark and can cause your credit score to plummet significantly. We're talking about potentially hundreds of points, depending on your credit history before the charge-off. It tells lenders you're a high-risk borrower, making it much harder to get approved for new credit cards, mortgages, car loans, or even personal loans at favorable interest rates. You might find yourself facing higher interest rates, larger down payments, or outright rejections.

It's also important to distinguish a charge-off from a collection. A charge-off is when the original creditor writes off the debt. A collection is when a third-party agency buys that charged-off debt and tries to collect it from you. Sometimes, a charged-off account will also appear as a collection account on your report, effectively hitting your score twice. This is why understanding the nuances is crucial for effective credit repair.

Strategies for Managing Charged Off Accounts Your Action Plan

Okay, so you have a charge-off. What's next? You've got a few main avenues to explore, and often, a combination of these will yield the best results.

Negotiating with the Original Creditor or Collection Agency Settlement Options

This is often your first and best line of defense. Even though the account is charged off, you can still try to negotiate with the original creditor or, more likely, the collection agency that now owns the debt. Your goal here is to settle the debt for less than the full amount. Collection agencies often buy debts for pennies on the dollar, so they have a lot of room to negotiate. They'd rather get something than nothing.

When negotiating, always aim for a 'pay for delete' agreement. This is where you agree to pay a certain amount (often 40-60% of the original debt, but sometimes even less) in exchange for the collection agency agreeing to remove the charge-off and collection entry from your credit report entirely. Crucially, get this agreement in writing before you make any payment. A verbal agreement isn't worth the paper it's not written on. If they refuse a pay for delete, you can still negotiate a settlement, but the entry will likely remain on your report, albeit updated to 'paid in full' or 'settled.' While not as good as a deletion, a 'paid' status is still better than an 'unpaid' one.

Product Recommendation: While not a 'product' in the traditional sense, a well-crafted negotiation letter is your best tool here. You can find templates online from reputable credit repair sites or consumer protection agencies. For example, sites like Credit.org or Consumer.ftc.gov offer resources and sample letters for debt negotiation. Some credit repair companies also offer services to help draft and send these letters on your behalf.

Disputing Inaccurate Charge Offs Credit Report Accuracy

Sometimes, a charge-off might appear on your credit report due to an error. This could be anything from incorrect account numbers, wrong dates, or even a debt that isn't yours due to identity theft. If you suspect an inaccuracy, you have the right to dispute it with the credit bureaus (Experian, Equifax, and TransUnion).

Gather all your documentation: account statements, payment records, and any correspondence related to the debt. Then, send a dispute letter to each credit bureau that reports the charge-off. They are legally obligated to investigate your dispute within 30 days. If they can't verify the information, they must remove it. This is a powerful tool, and it's why regularly checking your credit report is so important.

Product Recommendation: Credit monitoring services can be invaluable here. They alert you to changes on your credit report, making it easier to spot inaccuracies quickly. Some popular options include:

- IdentityIQ: Offers comprehensive credit monitoring from all three bureaus, identity theft protection, and credit reports/scores. It's a premium service, often costing around $29.99/month, but provides detailed insights and alerts.

- Credit Karma: Free service that provides VantageScore credit scores and reports from TransUnion and Equifax. While it doesn't offer FICO scores, it's excellent for monitoring changes and identifying potential errors.

- MyFICO: The official consumer division of FICO, offering access to your FICO scores and reports from all three bureaus. Plans range from $19.95 to $39.95 per month, providing the most accurate FICO data.

Statute of Limitations on Debt Knowing Your Rights

It's crucial to understand the statute of limitations (SOL) on debt in your state. This is the legal time limit during which a creditor or collection agency can sue you to collect a debt. Once the SOL expires, they can no longer take legal action. However, the debt doesn't disappear, and it can still remain on your credit report for up to seven years from the date of the first delinquency. The SOL varies by state and type of debt, typically ranging from 3 to 6 years.

Be very careful not to 're-age' the debt. Making a payment or even acknowledging the debt in writing can restart the SOL in some states, giving collectors more time to sue you. If the SOL has expired, you might have more leverage in negotiations, as their ability to sue you is gone. However, they can still try to collect, and the charge-off will still impact your credit until it naturally falls off.

Resource Recommendation: Websites like Nolo.com or your state's Attorney General's office website can provide specific information on the statute of limitations for debt in your area. It's always wise to consult with a consumer law attorney if you're unsure about your specific situation.

Credit Repair Companies When to Seek Professional Help

If dealing with charge-offs feels overwhelming, or if you have multiple negative items on your report, a reputable credit repair company might be a good option. These companies specialize in disputing inaccuracies, negotiating with creditors, and guiding you through the credit repair process. They can save you a lot of time and stress, but it's essential to choose wisely.

Comparison of Credit Repair Services:

- Credit Saint: Often highly rated for its aggressive dispute tactics and personalized approach. They offer three service tiers, with prices ranging from about $79.99 to $119.99 per month, plus an initial setup fee. They focus on challenging questionable items and have a strong money-back guarantee.

- Lexington Law: One of the largest and most well-known credit repair firms. They have a team of attorneys and paralegals who handle disputes and negotiations. Their services typically range from $89.95 to $129.95 per month, with an initial 'first work fee.' They are particularly good for complex cases involving multiple negative items.

- Ovation Credit Services: Known for its personalized service and competitive pricing, usually around $79-$109 per month. They offer two service packages, focusing on dispute letters, goodwill letters, and cease and desist letters. They also provide financial management tools.

- Sky Blue Credit Repair: Offers a single, straightforward service package at around $79 per month, plus a setup fee. They are known for their 90-day money-back guarantee and focus on rapid dispute processing. They're a good option if you want a simpler, more affordable approach.

Usage Scenario: If you have limited time, feel overwhelmed by the process, or have multiple complex negative items like charge-offs, collections, and bankruptcies, a credit repair company can be a valuable investment. They understand the legal nuances and have established processes for dealing with creditors and credit bureaus.

Rebuilding Your Credit After a Charge Off Proactive Steps

While you're working on managing or removing the charge-off, it's equally important to start rebuilding your credit. This involves demonstrating responsible financial behavior moving forward.

Secured Credit Cards Your Path to Recovery

A secured credit card is an excellent tool for rebuilding credit after a charge-off. You put down a security deposit, which typically becomes your credit limit. This minimizes risk for the lender, making them more likely to approve you even with a damaged credit history. Use it responsibly: make small purchases and pay the balance in full and on time every month. This consistent positive payment history will be reported to the credit bureaus and help improve your score.

Product Recommendations for Secured Credit Cards:

- Discover it Secured Credit Card: Often considered one of the best. It offers cash back rewards (1-2% on eligible purchases), reports to all three major credit bureaus, and Discover automatically reviews your account after 7 months to see if you qualify for an unsecured card and get your deposit back. Minimum deposit typically $200.

- Capital One Platinum Secured Credit Card: Another popular choice. It offers a low minimum security deposit (sometimes as low as $49 for a $200 credit line, depending on creditworthiness) and reports to all three bureaus. Capital One also offers a path to an unsecured card.

- OpenSky Secured Visa Credit Card: Unique because it doesn't require a credit check to apply, making it accessible even if your credit is severely damaged. You choose your credit limit by providing a security deposit (minimum $200). It reports to all three bureaus. Annual fee around $35.

Usage Scenario: If you've been denied for traditional unsecured credit cards due to your charge-off, a secured card is your best bet to start building positive payment history immediately.

Credit Builder Loans A Smart Alternative

A credit builder loan is another effective way to establish a positive payment history. With this type of loan, the money you borrow is held in a savings account or CD while you make monthly payments. Once the loan is paid off, you get access to the money. The lender reports your on-time payments to the credit bureaus, helping to build your score.

Product Recommendations for Credit Builder Loans:

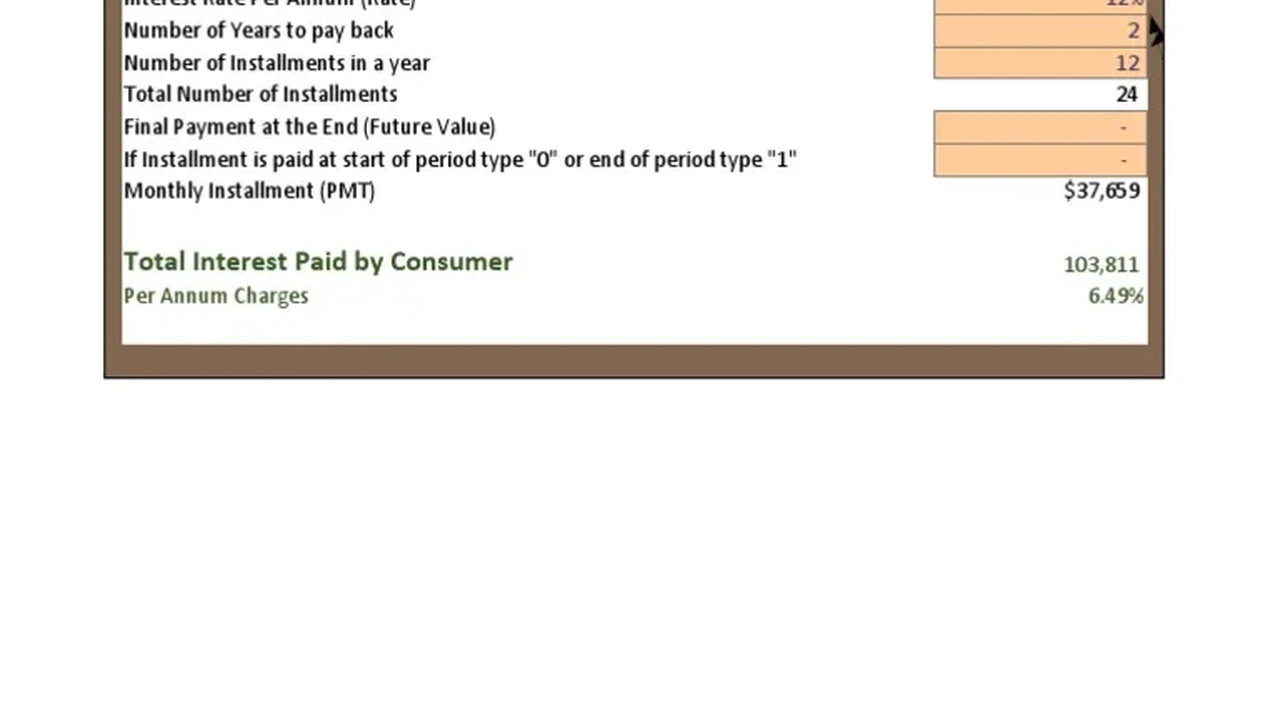

- Self Credit Builder Account: Very popular and widely available. You choose a loan amount (e.g., $500, $1,000) and a payment term (e.g., 12 or 24 months). Your monthly payments are reported to all three bureaus. Once paid off, you get the money. Fees and interest rates apply, but they are generally reasonable for the credit-building benefit.

- SeedFi Credit Builder Plan: Combines a credit builder loan with a line of credit. You make payments on the credit builder loan, and a portion of your payments becomes available as a line of credit. This offers both savings and immediate access to some funds.

- Local Credit Unions: Many local credit unions offer their own versions of credit builder loans, often with competitive rates and personalized service. It's worth checking with credit unions in your area.

Usage Scenario: If you prefer a loan structure over a credit card, or want to build savings while improving your credit, a credit builder loan is an excellent choice. It's also great if you struggle with the temptation to overspend on a credit card.

Authorized User Status Leveraging Others' Good Credit

If you have a trusted family member or friend with excellent credit, they might be willing to add you as an authorized user on one of their credit cards. When you're an authorized user, that account's positive payment history can appear on your credit report, potentially boosting your score. However, be aware that if the primary cardholder makes late payments or racks up high balances, it could negatively impact your score too. Choose wisely!

Usage Scenario: This is a quick way to get a boost, especially if you're just starting to rebuild. It's best used with someone you trust implicitly and who has a long history of responsible credit use.

Consistent On Time Payments The Golden Rule

This might sound obvious, but it's the most critical factor in credit repair. Make sure all your current and future payments – on any credit cards, loans, or bills – are paid on time, every single time. Payment history accounts for 35% of your FICO score, so consistent on-time payments are your best friend in overcoming a charge-off.

Tool Recommendation: Set up automatic payments for all your bills. Most banks and creditors offer this feature. You can also use budgeting apps like Mint or You Need A Budget (YNAB) to track due dates and ensure you never miss a payment. These apps often have features to link your accounts and provide reminders.

Monitoring Your Progress Staying on Top of Your Credit

As you implement these strategies, it's vital to regularly monitor your credit report and score. This allows you to track your progress, spot any new inaccuracies, and ensure that negative items are falling off as they should.

You're entitled to a free credit report from each of the three major credit bureaus once every 12 months via AnnualCreditReport.com. Take advantage of this! Review them carefully for any discrepancies. In addition to this, using the credit monitoring services mentioned earlier (IdentityIQ, Credit Karma, MyFICO) can provide ongoing insights and alerts.

Dealing with a charge-off is a marathon, not a sprint. It requires patience, persistence, and a strategic approach. But by understanding what a charge-off is, actively negotiating, disputing errors, and proactively rebuilding your credit, you can absolutely overcome this hurdle and get your financial health back on track. Keep at it, and you'll see your credit score improve over time!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)