Credit Repair Laws What You Need to Know

Understand the key credit repair laws that protect consumers and regulate credit repair organizations.

Understand the key credit repair laws that protect consumers and regulate credit repair organizations.

Credit Repair Laws What You Need to Know

Navigating the world of credit repair can feel like walking through a maze. You're trying to improve your financial standing, but you're also bombarded with promises and pitfalls. That's why understanding the laws designed to protect you is absolutely crucial. These laws aren't just legal jargon; they're your shield against predatory practices and your sword for asserting your rights. Let's dive deep into the most important credit repair laws, what they mean for you, and how they regulate the industry.

The Fair Credit Reporting Act FCRA Your Consumer Rights

The Fair Credit Reporting Act, or FCRA, is arguably the most important piece of legislation when it comes to your credit. Enacted in 1970, its primary purpose is to promote the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. Think of it as the bedrock of your credit rights. Without the FCRA, credit bureaus could operate with little oversight, and consumers would have minimal recourse against errors.

Key Provisions of the FCRA for Credit Repair

The FCRA grants you several powerful rights that are essential for credit repair:

- Right to Access Your Credit Report: You have the right to obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. You can do this through AnnualCreditReport.com. This is your starting point for any credit repair journey.

- Right to Dispute Inaccurate Information: This is where the FCRA truly shines for credit repair. If you find errors on your credit report, you have the right to dispute them with both the credit bureau and the information furnisher (the company that reported the information, like a bank or collection agency). The credit bureau must investigate your dispute, usually within 30 days, and remove or correct any inaccurate, incomplete, or unverifiable information.

- Right to Have Inaccurate Information Removed: If an investigation finds that information is inaccurate, incomplete, or cannot be verified, it must be removed from your credit report. This is a game-changer for improving your score.

- Right to Privacy: The FCRA limits who can access your credit report and for what purposes. Generally, only those with a legitimate business need (like lenders, landlords, or employers) can pull your report.

- Right to Damages: If a credit bureau or furnisher violates the FCRA, you may have the right to sue them for damages. This provides a strong incentive for them to comply with the law.

How the FCRA Empowers Your Credit Repair Efforts

Let's say you find a collection account on your report that you believe is incorrect. Under the FCRA, you can write a dispute letter to the credit bureau, explaining why you believe the information is wrong and providing any supporting documentation. The credit bureau then has to contact the collection agency to verify the debt. If the collection agency can't verify it, or doesn't respond within the FCRA's timeframe, the item must be removed. This process is fundamental to DIY credit repair.

The Credit Repair Organizations Act CROA Protecting Consumers from Scams

While the FCRA focuses on the accuracy of your credit report, the Credit Repair Organizations Act, or CROA, specifically targets companies that offer credit repair services. Enacted in 1996, CROA was a direct response to widespread fraud and deceptive practices within the credit repair industry. It sets strict rules for what credit repair organizations can and cannot do, aiming to protect consumers from being ripped off.

Key Protections Under CROA for Credit Repair Services

CROA provides several vital protections:

- No Upfront Fees: This is perhaps the most significant protection. Credit repair organizations cannot charge you or receive payment until they have fully performed the services they promised. If a company asks for money upfront, it's a red flag and a violation of CROA.

- Written Contract Required: You must be provided with a written contract that clearly outlines the services to be performed, the terms and conditions of payment, and an estimated timeframe for completion.

- Right to Cancel: You have a three-business-day right to cancel your contract with a credit repair organization without penalty.

- No False or Misleading Claims: Credit repair organizations cannot make false or misleading statements about their services or your ability to improve your credit. They cannot guarantee specific results or claim they can remove accurate negative information from your report.

- No Creation of New Credit Identities: They cannot advise you to create a new credit identity (e.g., using an Employer Identification Number instead of your Social Security Number), which is illegal.

Spotting CROA Violations and Avoiding Credit Repair Scams

CROA is your best defense against credit repair scams. If a company:

- Asks for payment before any services are rendered.

- Guarantees to remove accurate negative information.

- Tells you not to contact credit bureaus directly.

- Suggests creating a new credit identity.

- Doesn't provide a written contract.

These are all major red flags and likely CROA violations. Walk away immediately. Legitimate credit repair companies will always adhere to these rules.

The Fair Debt Collection Practices Act FDCPA Your Rights Against Debt Collectors

While not strictly a credit repair law, the Fair Debt Collection Practices Act, or FDCPA, is incredibly important for anyone dealing with debt, which often goes hand-in-hand with credit repair. The FDCPA protects consumers from abusive, deceptive, and unfair debt collection practices by third-party debt collectors.

How the FDCPA Impacts Your Credit Repair Journey

The FDCPA gives you rights when dealing with collection agencies, which can directly affect items on your credit report:

- Right to Debt Validation: Within 5 days of their initial communication, a debt collector must send you a written notice containing the amount of the debt, the name of the creditor, and a statement of your right to dispute the debt. If you dispute the debt in writing within 30 days, the collector must stop collection efforts until they provide verification of the debt. This is a powerful tool for ensuring accuracy before a collection account impacts your credit.

- Prohibition of Harassment: Collectors cannot harass, oppress, or abuse you. This includes using threats of violence, publishing lists of debtors, or using obscene language.

- Restrictions on Communication: Collectors cannot call you at unusual times or places (generally before 8 AM or after 9 PM local time), or at your place of employment if they know your employer prohibits such calls.

- No False or Misleading Statements: Collectors cannot lie about the amount you owe, falsely claim to be attorneys, or threaten legal action they don't intend to take.

Using the FDCPA to Your Advantage in Credit Repair

If a debt collector is reporting an inaccurate debt to the credit bureaus, or if they are violating your FDCPA rights, you can use this law to your advantage. Sending a debt validation letter can often lead to the collection account being removed from your credit report if the collector cannot verify the debt. Furthermore, if a collector violates the FDCPA, you can sue them, and any judgment against them could potentially lead to the removal of the negative item from your credit report.

State-Specific Credit Repair Laws Additional Protections

Beyond federal laws, many states have their own credit repair laws that offer additional protections to consumers. These state laws can sometimes be even stricter than federal laws, providing an extra layer of security. For example, some states might require credit repair organizations to be licensed or bonded, or they might have different rules regarding contracts and cancellation periods.

Why Knowing Your State Laws Matters for Credit Repair

If you're considering using a credit repair service, it's always a good idea to check your state's specific regulations. A quick search for "[Your State] credit repair laws" can provide valuable information. These laws can offer additional recourse if you encounter issues with a credit repair company operating within your state.

Choosing a Legitimate Credit Repair Service Understanding Your Options

Given the legal landscape, how do you choose a credit repair service that plays by the rules and genuinely helps you? It's about looking for companies that adhere to CROA and FCRA principles, and have a transparent, ethical approach.

Top Credit Repair Services and Their Offerings

When evaluating credit repair services, consider these reputable options that generally operate within legal guidelines:

1. Credit Saint

- Overview: Credit Saint is often highly rated for its aggressive approach to challenging negative items. They offer three different service tiers, each with varying levels of dispute services and support.

- Key Features: They offer a 90-day money-back guarantee, which is a strong indicator of their confidence in their services. They focus on challenging inaccuracies, late payments, collections, bankruptcies, and more.

- Pricing: Their plans typically range from around $79.99 to $129.99 per month, plus an initial first-work fee (which is charged after services begin, adhering to CROA).

- Use Case: Best for individuals with multiple negative items and those who want a comprehensive, hands-off approach to credit repair.

- Comparison: Compared to DIY, Credit Saint offers expertise and saves you time. Compared to other services, their money-back guarantee and tiered approach can be appealing.

2. Lexington Law Firm

- Overview: As a law firm, Lexington Law brings a legal perspective to credit repair. They employ attorneys and paralegals to challenge inaccuracies on your behalf.

- Key Features: They focus on leveraging consumer protection laws like FCRA and FDCPA. They offer different service levels, including dispute letters, cease and desist letters to collectors, and identity theft protection.

- Pricing: Monthly fees typically range from $89.95 to $129.95, with an initial first-work fee.

- Use Case: Ideal for those who prefer a legal team handling their disputes, especially if they have complex issues like bankruptcies or identity theft.

- Comparison: Their legal backing can be a significant advantage over non-legal credit repair organizations, potentially leading to more effective disputes.

3. Sky Blue Credit Repair

- Overview: Sky Blue is known for its straightforward pricing and a strong focus on customer service. They offer a single, comprehensive service plan.

- Key Features: They offer unlimited disputes and challenges per cycle, which can be beneficial for those with many errors. They also provide credit score analysis and proactive advice. They have a 90-day money-back guarantee.

- Pricing: Around $79 per month, plus an initial setup fee.

- Use Case: A good option for individuals looking for a reliable, no-frills service with a clear pricing structure and excellent customer support.

- Comparison: Their unlimited disputes can be more cost-effective than tiered plans from other companies if you have numerous items to challenge.

4. Credit Karma (Free Tool)

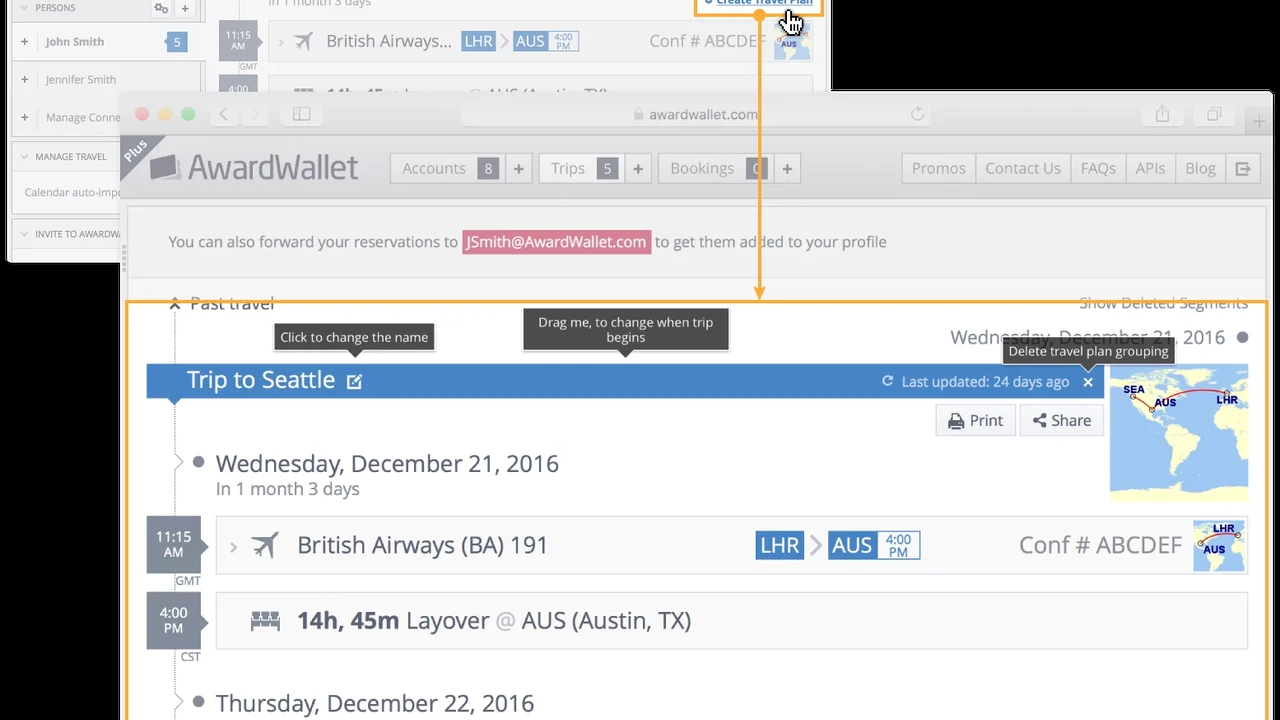

- Overview: While not a credit repair service in the traditional sense, Credit Karma is an invaluable free tool for monitoring your credit and identifying errors.

- Key Features: Provides free credit scores (VantageScore 3.0 from TransUnion and Equifax), credit reports, and monitoring. It also offers tools to dispute errors directly through their platform.

- Pricing: Free.

- Use Case: Essential for anyone doing DIY credit repair. It helps you identify what needs to be disputed and track your progress.

- Comparison: It's not a service that does the work for you, but it's a crucial first step and ongoing monitoring tool that complements any credit repair strategy.

What to Look for in a Credit Repair Company

- CROA Compliance: No upfront fees, written contract, right to cancel.

- Transparency: Clear pricing, realistic expectations, and open communication.

- Reputation: Check reviews on independent sites like the Better Business Bureau (BBB), Consumer Financial Protection Bureau (CFPB), and other consumer review platforms.

- Customer Service: How accessible and helpful are they?

- Guarantees: While no one can guarantee specific results, a money-back guarantee (like Credit Saint or Sky Blue) shows confidence.

- Education: Do they educate you on how to maintain good credit after repair?

DIY Credit Repair Leveraging the Laws Yourself

You don't always need to hire a company to repair your credit. Armed with knowledge of the FCRA and FDCPA, you can often achieve significant results on your own. This approach saves money and gives you direct control over the process.

Steps for Effective DIY Credit Repair

- Get Your Free Credit Reports: Start at AnnualCreditReport.com. Get reports from all three bureaus.

- Review Thoroughly: Go through each report line by line. Look for inaccuracies: wrong account numbers, incorrect balances, accounts that aren't yours, duplicate entries, outdated information (most negative items should fall off after 7 years, bankruptcies after 10).

- Gather Documentation: Collect any evidence that supports your claim (e.g., payment receipts, canceled checks, court documents, identity theft reports).

- Write Dispute Letters: Send dispute letters to the credit bureaus for each inaccurate item. Be specific about what you're disputing and why. Include copies of your supporting documents (never originals). Send via certified mail with a return receipt requested.

- Dispute with Furnishers: Simultaneously, send dispute letters to the original creditors or collection agencies (the furnishers) that reported the inaccurate information. This is also a good time to send a debt validation letter to collection agencies if you suspect the debt is invalid or inaccurate, leveraging the FDCPA.

- Monitor Your Reports: Keep checking your credit reports regularly to see if the disputed items have been removed or corrected.

- Follow Up: If the credit bureau or furnisher doesn't respond within the legal timeframe (usually 30 days), or if they don't remove the inaccurate item, you can follow up with another letter or consider filing a complaint with the CFPB or your state's Attorney General.

Tools and Resources for DIY Credit Repair

- AnnualCreditReport.com: Your official source for free credit reports.

- Credit Karma / Credit Sesame: Free services to monitor your credit scores and reports, and often provide dispute tools.

- Consumer Financial Protection Bureau (CFPB): A government agency that provides resources, sample letters, and a platform to file complaints against credit bureaus, furnishers, or debt collectors.

- Federal Trade Commission (FTC): Offers consumer information on credit repair and avoiding scams.

- Sample Dispute Letters: Many reputable financial websites and the CFPB offer templates for dispute letters.

The Role of Government Agencies in Credit Repair Enforcement

Several government agencies play a crucial role in enforcing credit repair laws and protecting consumers. Knowing about them can provide you with additional avenues for recourse if you encounter problems.

Key Agencies and Their Functions

- Consumer Financial Protection Bureau (CFPB): This agency is a powerhouse for consumer protection. They enforce federal consumer financial laws, including the FCRA and CROA. You can file complaints with the CFPB against credit bureaus, furnishers, debt collectors, and credit repair organizations. They often mediate disputes and can take enforcement actions.

- Federal Trade Commission (FTC): The FTC protects consumers from deceptive and unfair business practices. They also enforce CROA and provide extensive educational resources on credit repair scams.

- State Attorneys General: Your state's Attorney General office can also investigate and take action against credit repair organizations that violate state or federal laws. They are a valuable resource for state-specific protections.

When to Contact a Government Agency

If you've tried to dispute an item with a credit bureau or furnisher and haven't gotten a satisfactory resolution, or if you believe a credit repair organization has violated CROA, filing a complaint with the CFPB or FTC is a smart next step. These complaints can trigger investigations and help protect other consumers.

Common Misconceptions About Credit Repair Laws

There are many myths surrounding credit repair, often fueled by unscrupulous companies. Let's clear up some common misunderstandings.

Myth 1 Credit Repair Companies Can Remove Accurate Negative Information

Reality: This is a common lie. No legitimate credit repair company can legally remove accurate, verifiable negative information from your credit report before its statutory reporting period ends (usually 7 years for most negative items, 10 for bankruptcy). Their job is to challenge inaccuracies and ensure everything reported is fair and verifiable. If an item is accurate and verifiable, it will stay on your report.

Myth 2 You Need a New Credit Identity to Start Fresh

Reality: This is illegal and a serious federal offense. Creating a new credit identity using an EIN or a CPN (Credit Privacy Number) is considered fraud. Legitimate credit repair focuses on improving your existing credit identity, not creating a fake one.

Myth 3 Credit Repair is a Quick Fix

Reality: Credit repair takes time. While some inaccuracies can be removed quickly, a comprehensive repair process can take several months, sometimes even a year or more, depending on the complexity of your credit profile. Be wary of companies promising instant results.

Myth 4 Only Professionals Can Repair Credit

Reality: As discussed, you have every right and ability to repair your own credit using the FCRA. While professionals can save you time and effort, especially with complex cases, DIY is a perfectly viable and often successful option.

Staying Informed and Protecting Your Credit

Understanding credit repair laws isn't just about fixing past mistakes; it's about empowering yourself for a healthier financial future. By knowing your rights under the FCRA, CROA, and FDCPA, you can confidently navigate the credit landscape, protect yourself from scams, and take effective steps to improve your creditworthiness. Regularly checking your credit reports, disputing inaccuracies, and being vigilant about who you trust with your financial information are ongoing practices that will serve you well.

Remember, your credit report is a reflection of your financial history, and you have the legal right to ensure that reflection is accurate and fair. Use these laws as your guide, whether you choose to tackle credit repair yourself or enlist the help of a reputable service.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)