Removing Hard Inquiries from Your Credit Report

Learn if and how you can remove hard inquiries from your credit report to minimize their impact on your score.

Removing Hard Inquiries from Your Credit Report

Hard inquiries on your credit report can feel like tiny, annoying dents on an otherwise pristine financial record. While a single hard inquiry might not drastically impact your credit score, a cluster of them can certainly raise an eyebrow with lenders and potentially lower your score by a few points. This article will delve deep into understanding hard inquiries, their impact, and most importantly, if and how you can get them removed from your credit report. We'll also explore some specific tools and services that can assist you in this process, along with their typical costs and use cases.

What is a Hard Inquiry and Why Does it Matter for Your Credit Score?

A hard inquiry, also known as a 'hard pull' or 'hard credit check,' occurs when a lender or creditor checks your credit report to make a lending decision. This usually happens when you apply for a new credit card, a mortgage, an auto loan, a personal loan, or even some rental applications. The key characteristic of a hard inquiry is that it indicates you are seeking new credit, which can be seen as a risk factor by other lenders. Each hard inquiry can temporarily lower your credit score by a few points, typically between 3 to 5 points, and remains on your credit report for two years, though its impact diminishes significantly after the first year.

Hard Inquiries vs Soft Inquiries Understanding the Difference

It's crucial to distinguish between hard and soft inquiries. A soft inquiry, or 'soft pull,' occurs when you check your own credit score, or when a lender pre-approves you for an offer without you formally applying. Soft inquiries do not affect your credit score and are not visible to other lenders. Examples include checking your credit score through a credit monitoring service, receiving pre-approved credit card offers in the mail, or employers performing a background check. Understanding this difference is vital so you don't panic every time you see a credit check.

When Can You Remove Hard Inquiries from Your Credit Report?

The short answer is: rarely, but it's not impossible. Legitimate hard inquiries, those made with your permission when you applied for credit, generally cannot be removed. They are an accurate reflection of your credit activity. However, there are specific circumstances under which you can dispute and potentially remove a hard inquiry:

Unauthorized Hard Inquiries Protecting Your Financial Identity

This is the most common and legitimate reason for removal. If a hard inquiry appears on your credit report that you did not authorize, it could be a sign of identity theft or an error. In such cases, you have every right to dispute it. This often happens if someone applies for credit in your name without your knowledge or if a lender pulls your credit report by mistake.

Fraudulent Hard Inquiries Combating Identity Theft

Similar to unauthorized inquiries, fraudulent inquiries are a direct result of identity theft. If you suspect identity theft, removing these inquiries is a critical step in restoring your credit. This often involves filing a police report and working with the credit bureaus.

Inaccurate Hard Inquiries Correcting Reporting Errors

Sometimes, a hard inquiry might be legitimate but contain inaccurate information. For example, the date might be wrong, or the lender's name might be misspelled. While less common, such inaccuracies can sometimes be grounds for dispute, especially if they lead to confusion or misrepresentation of your credit activity.

Step by Step Guide to Removing Hard Inquiries from Your Credit Report

If you believe you have a valid reason to remove a hard inquiry, here's a detailed process to follow:

Step 1 Obtain Your Credit Reports for Free

The first step is to get copies of your credit reports from all three major credit bureaus: Experian, Equifax, and TransUnion. You can do this for free once every 12 months at AnnualCreditReport.com. Carefully review each report for any hard inquiries you don't recognize or believe are inaccurate.

Step 2 Identify Unauthorized or Inaccurate Inquiries

Go through each hard inquiry listed. Do you remember applying for credit with that specific lender on that date? If not, mark it as potentially unauthorized or inaccurate. Pay close attention to the dates and the names of the creditors.

Step 3 Contact the Creditor First for Resolution

If you identify an unauthorized inquiry, your first point of contact should be the creditor who made the inquiry. Explain that you did not authorize the inquiry and request its removal. Provide them with any supporting documentation you have. Sometimes, it's a simple error on their part, and they can remove it directly. Keep detailed records of all communications, including dates, names of people you spoke with, and summaries of conversations.

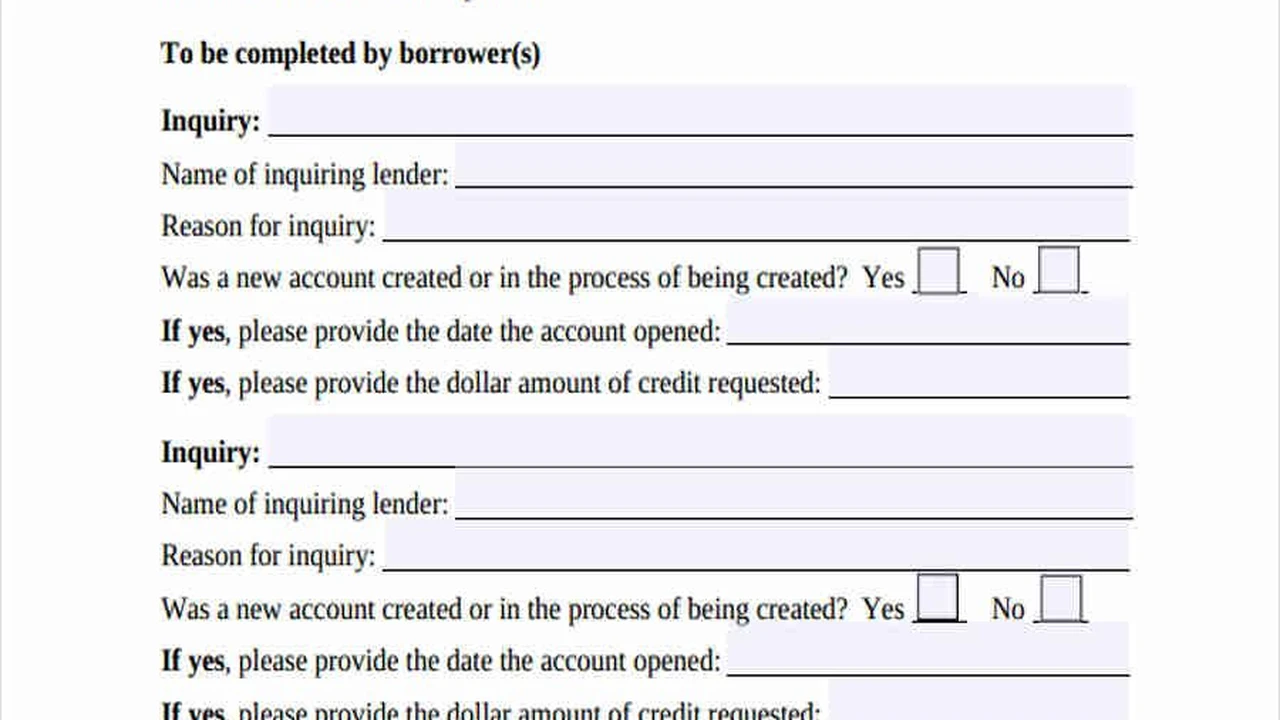

Step 4 Dispute with the Credit Bureaus for Removal

If the creditor doesn't remove the inquiry, or if you suspect identity theft, you'll need to dispute it directly with each credit bureau where the inquiry appears. You can do this online, by mail, or by phone. Each bureau has a dedicated dispute process:

- Experian: Visit their dispute center online or mail a letter.

- Equifax: Use their online dispute form or send a letter.

- TransUnion: Access their dispute page or mail your dispute.

When disputing, clearly state that the inquiry is unauthorized or inaccurate. Provide any evidence you have, such as a police report (if identity theft is involved), a copy of your communication with the creditor, or any other relevant documents. The credit bureaus are legally required to investigate your dispute within 30 days (45 days in some cases) and inform you of the outcome.

Step 5 File a Police Report for Identity Theft

If you suspect identity theft, filing a police report is crucial. This document provides official proof of the crime and strengthens your dispute with both the creditors and the credit bureaus. You should also file a report with the Federal Trade Commission (FTC) at IdentityTheft.gov. The FTC will provide you with an identity theft report and a recovery plan, which are invaluable for disputing fraudulent activity.

Credit Repair Services and Tools for Hard Inquiry Removal

While you can certainly attempt to remove hard inquiries yourself, credit repair services can be a valuable asset, especially if you have multiple unauthorized inquiries or are dealing with complex identity theft issues. These services specialize in navigating the credit dispute process and communicating with creditors and credit bureaus on your behalf.

Top Credit Repair Companies for Inquiry Removal

Here are a few reputable credit repair companies that can assist with hard inquiry removal, along with their typical offerings and pricing:

1. Credit Saint Comprehensive Credit Repair Solutions

- Use Case: Ideal for individuals with multiple negative items, including unauthorized hard inquiries, collections, and late payments. They offer a comprehensive approach to credit repair.

- Services: Credit Saint offers three different service packages: Credit Polish, Credit Remodel, and Credit Score Xpert. All packages include disputes for inaccurate information, including hard inquiries. The higher-tier packages offer more aggressive dispute strategies and additional features like inquiry targeting and score analysis.

- Pricing: Monthly fees typically range from $79.99 to $119.99, plus an initial first-work fee of $99.00 to $195.00.

- Pros: Strong reputation, money-back guarantee, personalized approach, and good customer support.

- Cons: Can be more expensive than DIY, results are not guaranteed.

2. Lexington Law Firm Legal Expertise for Credit Disputes

- Use Case: Best for those who prefer a law firm's expertise in handling credit disputes, especially for complex cases involving legal nuances or persistent errors.

- Services: Lexington Law offers three service tiers: Concord Standard, Concord Premier, and PremierPlus. All tiers include challenging inaccurate hard inquiries. Premier and PremierPlus offer additional services like FICO score tracking, identity theft protection, and cease and desist letters to creditors.

- Pricing: Monthly fees range from $89.95 to $129.95, with an initial first-work fee of $14.95.

- Pros: Legal backing for disputes, experienced paralegals, good track record for removing inaccurate items.

- Cons: Can be pricey, results vary based on individual credit profile.

3. Sky Blue Credit Repair Affordable and Effective

- Use Case: A good option for those looking for an affordable yet effective credit repair service, particularly if you have a manageable number of disputes.

- Services: Sky Blue Credit offers a single, straightforward service package that includes disputing inaccurate items, including hard inquiries, and providing guidance on credit building. They have a unique 'pause or cancel anytime' policy.

- Pricing: A monthly fee of $79.00, plus an initial setup fee of $79.00.

- Pros: Affordable, transparent pricing, 90-day money-back guarantee, and a focus on customer satisfaction.

- Cons: Less comprehensive than some higher-priced competitors, may not be suitable for very complex cases.

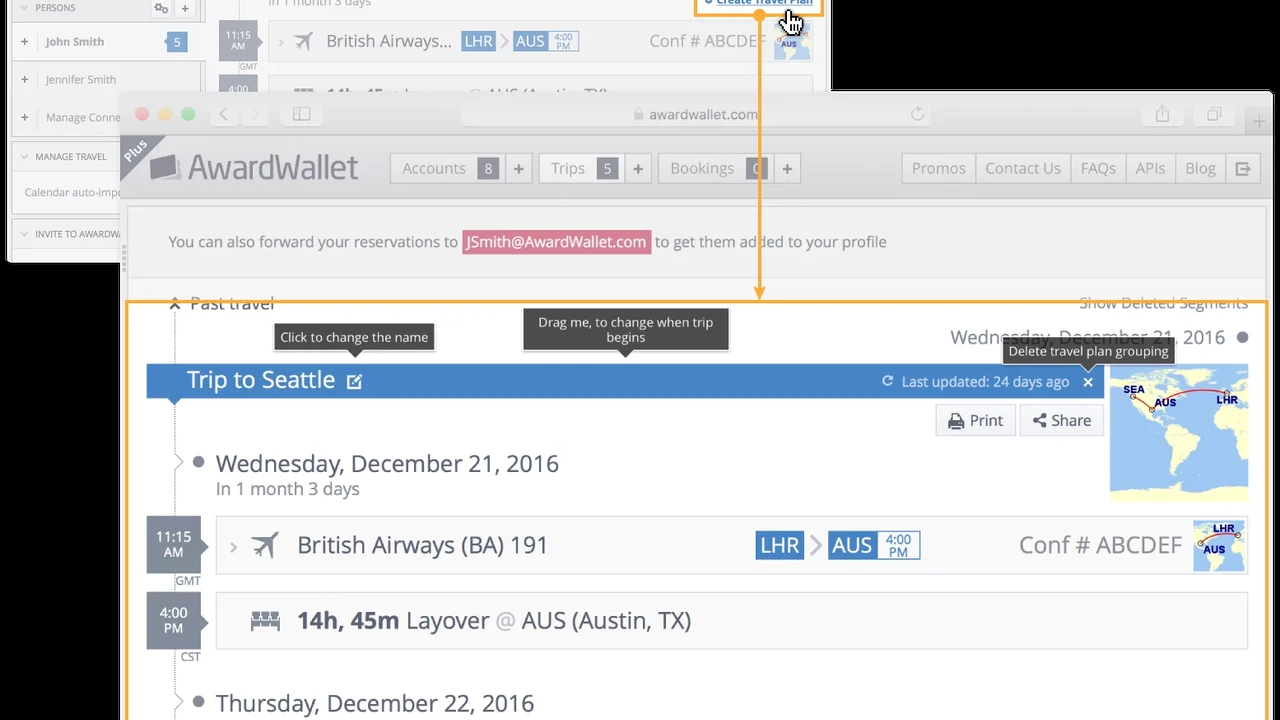

Credit Monitoring Services for Early Detection

While not directly for removal, credit monitoring services are invaluable for early detection of unauthorized hard inquiries. They alert you whenever there's a significant change to your credit report, including new inquiries. This allows you to act quickly and dispute any suspicious activity before it causes further damage.

1. IdentityIQ Comprehensive Credit Monitoring

- Use Case: Excellent for individuals who want robust credit monitoring across all three bureaus, identity theft protection, and regular credit score updates.

- Services: IdentityIQ offers 3-bureau credit reports and scores, daily monitoring, dark web monitoring, and identity theft insurance. They send alerts for new inquiries, allowing you to quickly identify and dispute unauthorized ones.

- Pricing: Plans typically range from $29.99 to $34.99 per month.

- Pros: Comprehensive monitoring, frequent updates, identity theft protection.

- Cons: Monthly subscription cost, not a credit repair service itself.

2. MyFICO Direct from the Source

- Use Case: Ideal for those who want to track their FICO scores specifically and receive alerts directly from the most widely used credit scoring model.

- Services: MyFICO provides FICO scores from all three bureaus, credit reports, and monitoring with alerts for new inquiries. They offer various FICO score versions used by different lenders.

- Pricing: Plans range from $19.95 to $39.95 per month.

- Pros: Access to multiple FICO scores, direct alerts, educational resources.

- Cons: Can be more expensive, primarily focused on FICO scores.

Preventing Future Hard Inquiries Smart Credit Habits

The best defense is a good offense. By adopting smart credit habits, you can minimize the number of hard inquiries on your report and protect your financial health:

Bundle Your Applications Strategic Credit Seeking

If you know you'll need multiple types of credit (e.g., a mortgage and an auto loan), try to apply for them within a short window (typically 14-45 days, depending on the scoring model). Credit scoring models often treat multiple inquiries for the same type of loan within this period as a single inquiry, recognizing that you're rate shopping. This is particularly true for mortgages and auto loans.

Only Apply for Credit When Necessary Avoid Impulse Applications

Resist the urge to apply for every credit card offer you receive or to open store credit cards just for a small discount. Each application results in a hard inquiry. Only apply for credit when you genuinely need it and are confident you'll be approved.

Monitor Your Credit Reports Regularly Vigilance is Key

As mentioned, regularly checking your credit reports (at least annually, but ideally more frequently through monitoring services) is crucial. This allows you to spot any unauthorized inquiries or errors quickly and take immediate action.

Understand Pre-Approvals vs Pre-Qualifications Know the Difference

Many lenders offer 'pre-approvals' or 'pre-qualifications' that involve a soft inquiry. This allows you to gauge your eligibility without impacting your score. Only proceed with a full application (which triggers a hard inquiry) once you're serious about obtaining the credit.

The Long Term Impact of Hard Inquiries and Credit Health

While hard inquiries have a relatively minor and temporary impact on your credit score, their cumulative effect can be more significant if you have many in a short period. Lenders view frequent credit seeking as a sign of financial distress or a higher risk. Maintaining a healthy credit profile involves a balance of responsible credit use, timely payments, and strategic credit applications. By understanding how hard inquiries work and knowing when and how to dispute them, you empower yourself to better manage your credit and achieve your financial goals.

Remember, patience and persistence are key when dealing with credit disputes. Keep meticulous records, follow up regularly, and don't hesitate to seek professional help if your situation becomes too complex to handle on your own. Your credit health is a marathon, not a sprint, and every step you take to protect it contributes to your long-term financial well-being.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)